Engagement & Retention project | Groww

Hi there, we'll take this one step at a time!

If you struggle with a blank canvas, use this boilerplate to start. Remember, this is a flexible resource—tweak it as needed. Some sections might not apply to your product and you might come up with great ideas not listed here, don't let be restricted.

This is not the only format, we would love to see you scope out a great format for your product!

Go wild and dive deep—we love well-researched documents that cover all bases with depth and understanding.

Please delete any unused boilerplate material before making your final submission.

Let’s begin!

Groww’s Core Value Proposition 🚀

"Groww simplifies and democratizes investing, making wealth creation accessible, effortless, and safe for everyone."

Step 1: Defining Groww’s Core Business & Benefits

✅ What business is Groww in?

Groww is in the business of making investing easy, secure, and transparent for retail investors.

✅ What problem does Groww solve?

- Complexity of investing – Many first-time investors find traditional platforms confusing.

- Lack of transparency – Traditional brokers have hidden charges, making it hard to trust them.

- Security concerns – Online scams, fraud, and phishing attacks make people hesitant to invest digitally.

- Fragmented financial management – Users need multiple platforms to manage different asset classes.

✅ Key features & customer benefits:

🚀 Zero-commission investing – No hidden charges, unlike traditional brokers.

📲 Simplified UI/UX – Investing is as easy as shopping online.

📊 All investments in one place – Stocks, mutual funds, gold, and US stocks in a single app.

🎓 Financial education – Blogs, videos, and tools to help users make informed decisions.

🔍 Transparent insights – Clear breakdowns of risks, fees, and returns before investing.

🛡 Bank-grade security – End-to-end encryption, two-factor authentication, and fraud detection systems protect user accounts.

🔔 Real-time fraud alerts – Instant notifications for suspicious activities or unauthorized login attempts.

✅ SEBI-registered & compliant – Adheres to all regulatory guidelines to ensure user protection.

Step 2: Insights from Groww’s Best Customers

💬 Why do users choose Groww over competitors?

- "It’s super easy to use, even for beginners."

- "I trust Groww because they make everything transparent—no hidden fees."

- "I feel safe using Groww because of their security features."

💬 Why do they keep using Groww?

- "The interface is intuitive, and I trust Groww’s security measures."

- "I can invest without worrying about fraud or scams."

- "The two-factor authentication and fraud alerts give me peace of mind."

💬 How would they describe Groww to a friend?

- "It’s like the Swiggy of investing—fast, simple, and hassle-free."

- "If you want to start investing but don’t know how, just use Groww—it’s safe and easy."

Step 3: Analyzing & Defining the Core Value Proposition

From the insights gathered, Groww’s core differentiator is its ability to simplify investing while keeping it safe, transparent, and accessible.

✨ Core Value Proposition Statement

“Groww removes the barriers to investing by offering a simple, fast, and secure platform where anyone—beginners or experts—can build wealth with confidence.”

🌟 What Makes Groww Stand Out?

✅ Simplicity – Investing is as easy as ordering food online.

✅ Transparency – No hidden charges, full cost breakdowns before investing.

✅ Security – Bank-grade encryption, two-factor authentication, and fraud detection systems.

✅ Regulatory Compliance – SEBI-registered and follows all investment safety norms.

✅ Accessibility – No paperwork, instant onboarding, easy-to-understand insights.

✅ Comprehensive – One platform for stocks, MFs, gold, and US markets.

✅ Empowering – Education-driven approach helps users make smarter decisions.

Natural Frequency 📊

Natural Frequency of Groww Users | |

|---|---|

User Type | Natural Frequency |

Casual User | 1-2 times a month (to check portfolio or invest in MFs) |

Core User | 1-2 times a week (actively tracking and making investments) |

Power User | Daily or multiple times a day (trading stocks, checking market trends, investing aggressively) |

Insights from Natural Frequency Analysis

- Casual Users (low frequency)

- Typically invest in mutual funds or SIPs and check their portfolio only when needed.

- May require nudges like market insights, performance alerts, and educational content to increase engagement.

- Core Users (medium frequency)

- Actively track their investments and make trades occasionally.

- Likely to engage with features like price alerts, expert insights, and portfolio rebalancing.

- Power Users (high frequency)

- Actively trade stocks, ETFs, and mutual funds daily.

- Engage with real-time market data, advanced analytics, and high-frequency trading tools.

How Can We Improve Natural Frequency?

To increase user engagement, we can introduce features that increase interactions without overwhelming users:

- For Casual Users:

- Monthly digest emails with portfolio performance & market insights.

- Push notifications when their investments hit a milestone (e.g., "Your SIP has grown by 10%!")

- For Core Users:

- Smart alerts (e.g., "Your stock price target has been reached!")

- Market updates & trend analysis to encourage frequent logins.

- For Power Users:

- Advanced trading tools like custom watchlists and AI-based stock recommendations.

- Live discussions, expert webinars, and real-time alerts for immediate decision-making.

Since, Groww does not currently have a premium pricing plan—it primarily earns through brokerage fees, commission on mutual funds, and interest on uninvested funds. There can be two types of users:

1. Free users ( Casual Investors & Beginners)

2. Paid User ( Active Investors & Traders)

Actions That Define an Active User

Free User (Casual Investors & Beginners)

- Logs in at least once a week to check portfolio performance

- Uses Groww to track all mutual funds linked to their PAN

- Reads educational content, market insights, or stock analysis

- Uses watchlists, price alerts, or basic charting tools

- Explores new investment options but hasn’t made a transaction yet

- Has completed KYC verification but hasn’t actively traded

Paid User (Active Investors & Traders)

a) Long-Term Investor

- Invests in mutual funds, SIPs, or ETFs at least once per quarter

- Buys or sells stocks occasionally based on market movements

- Logs in monthly to check portfolio, rebalance, or add investments

- Uses IPO applications through Groww

- Refers Groww to family/friends

b) Active Trader

- Buys or sells stocks at least once a week

- Uses advanced features like technical indicators, market-depth analysis, and live charts

- Trades derivatives like Futures & Options (if available on Groww)

- Tracks daily stock movements & engages with Groww’s market insights

- Uses margin trading or intraday trading features frequently

ICP for Groww:

Criteria | ICP 1: Beginner Investor ("Wealth Builder") | ICP 2: Active Trader ("Stock Market Enthusiast") | ICP 3: Long-Term Investor ("Wealth Preserver") |

Name | Aman Tyagi | Shivam Taneja | Neeraj Chauhan |

Age | 22-35 | 25-40 | 35-50 |

Demographics | Urban professionals, middle-class income, working in IT, finance, healthcare | Upper-middle-class, finance & business professionals, entrepreneurs | High-income professionals, CXOs, doctors, senior executives |

Need | Wants an easy way to start investing with minimal risk | Wants to trade stocks, options & futures actively for short-term gains | Wants to build and preserve long-term wealth efficiently |

Pain Point | - Overwhelmed by investment choices - No prior experience - Lacks financial literacy | - Needs real-time data & analytics - High brokerage fees - Needs better trading tools | - Needs portfolio diversification - Wants low-risk, high-stability options - Concerned about wealth security & fraud |

Solution | - Guided investment plans - Goal-based SIPs - Beginner-friendly UI & tutorials | - Low brokerage fees - Advanced charting & alerts - Faster order execution | - Premium advisory services - High-interest fixed deposits & bonds - Tax-optimized investing |

Behavior | - First-time investor - Prefers simple, automated investments - Engages with financial education content | - High-frequency trader - Uses technical analysis tools - Needs fast transactions & alerts | - Low trading frequency - Invests in mutual funds, ETFs, bonds - Seeks personalized investment advice |

Perceived Value of Groww | Safe, easy, beginner-friendly investing | Low-cost, feature-rich trading platform | Secure, stable wealth management |

Marketing Pitch | "Start your investment journey with just ₹100. No experience needed!" | "Powerful trading tools, lowest brokerage fees. Take your investments to the next level!" | "Preserve & grow your wealth with safe, high-return investment options." |

Goals | Build wealth passively with minimal effort | Maximize short-term gains through active trading | Ensure wealth security & financial stability |

Frequency of use case | Weekly/monthly | Daily/multiple times a day | Monthly/quarterly |

Average Spend on Groww | ₹5,000 - ₹25,000 per month (SIP, mutual funds) | ₹50,000 - ₹2,00,000 per month (trading) | ₹10 lakh+ (FDs, bonds, premium investment services) |

Value Accessibility | High – Needs simple onboarding & UI | Medium – Needs fast trade execution & real-time data | Low – Needs personalized customer support & advisory |

Value Experience | Easy, guided, low-risk investing | Fast, feature-rich, analytics-driven trading | Secure, high-value investment solutions |

Notes | Needs financial literacy & guidance before investing | Requires zero-lag execution & premium tools to trade efficiently | Needs trust, safety, and premium financial advice |

RFM-Based User Segmentation for Groww | |||

User Type | Casual User (Beginner Investor) | Core User (Active Trader) | Power User (Diverse Portfolio Investor) |

Usage Characteristics | - Primarily SIP & mutual fund investors - Uses Groww for learning content - Low-frequency transactions | - Trades in stocks & F&O actively - Uses real-time charts & alerts - Engages with market news & trends | - Invests in stocks, US stocks, gold, ETFs, mutual funds - Prefers long-term wealth creation |

Recency of Use Case | 🟡 Moderate (logs in weekly/monthly) | 🟢 High (logs in daily/multiple times per day) | 🔴 Low (logs in quarterly for rebalancing) |

Natural Frequency | 🟡 Medium (occasional investing) | 🟢 High (daily trading) | 🔴 Low (long-term holding) |

Monetary Value (AOV/Revenue Generated) | ₹5,000 - ₹25,000/month | ₹50,000 - ₹2,00,000/month | ₹10 lakh+ |

Pain Points | - Overwhelmed by investment choices - Unsure how to start investing | - High brokerage fees for frequent trades - Needs detailed analytics & stock alerts | - Wants low-risk diversification - Concerned about fraud & security |

Valued Features (Groww-Specific) | - SIP auto-investment - Mutual fund selection tools - Stock learning content | - Live stock price tracking & alerts - F&O trading with margin benefits - Advanced charts & market news | - US stocks, gold & ETFs investment options - Portfolio tracking tools & risk assessment |

Core Value Proposition (CVP) Used | - Easy & guided investing | - Low-cost, fast trading | - Diverse, secure investment portfolio |

JTBD (Jobs-To-Be-Done) of Persona | - Start investing with minimal risk | - Maximize short-term trading profits | - Build a long-term diversified portfolio |

Discovery Channels | Social media, YouTube finance influencers | Business news, Telegram trading groups | Wealth advisory forums, LinkedIn finance groups |

Level of Engagement | 🟡 Medium (Engages with educational content) | 🟢 High (Uses Groww’s trading features daily) | 🔴 Low (Logs in only for portfolio checkups) |

Feature-Aligned Engagement Strategy Based on RFM Segments

Segment | Engagement Strategy (Feature-Based) |

Casual Users (Potential Investors) | - Nurture through Groww’s stock learning modules & videos 📚 - Promote SIP & auto-investment features to increase frequency - Push mutual fund recommendations based on risk profile |

Core Users (Power Traders) | - Provide real-time stock alerts & news updates 🔔 - Improve engagement through low-cost F&O trading offers 💹 - Enhance experience with advanced stock analytics & insights 📊 |

Power Users (Wealth Builders) | - Position US stocks, gold, and ETFs for portfolio diversification 🌍 - Offer risk assessment tools & secure investing features 🔐 - Reinforce security & fraud protection messaging for trust ✅ |

Validation of the segmentation:

After doing a deep dive for customer segmentation, it is necessary for us to validate the segmentation. We can use the following methods to- do so.

1. Feature Alignment Check

Objective:

- Validate that the segments are aligned with Groww’s actual offerings.

- Ensure that each user segment’s behavior matches the features they engage with.

| User Segment | Primary Features Used | Feature Adoption Validation |

|---|---|---|

Casual Users | Mutual Funds, SIPs, Stock Watchlists | ✅ High adoption of mutual funds & SIPs |

Core Users | Stocks Trading, ETFs, Gold Investment | ✅ Active traders in equities & ETFs |

Power Users | F&O, US Stocks, Margin Trading, IPOs | ✅ High-volume traders engaging in derivatives |

Validation Approach:

- Data Source: Groww’s analytics dashboard, feature usage reports.

- Key Insight: Power users tend to adopt advanced features like F&O, while casual users primarily stick to SIPs and stock watchlists.

2. Behavioral Data Analysis

Objective:

- Validate segmentation by analyzing actual user behavior.

| Behavioral Metric | Casual User | Core User | Power User |

|---|---|---|---|

Avg. Monthly Transactions | 1-2 | 5-10 | 20+ |

Recency of Use | Monthly | Weekly | Daily |

Avg. Portfolio Size | < ₹10K | ₹50K-₹1L | ₹5L+ |

Feature Stickiness | Watchlists, SIP Reminders | Live Stock Data, ETFs | Leverage Trading, US Stocks |

Validation Approach:

- Data Source: Backend logs, transaction history, engagement analytics.

- Key Insight: Users who engage with live stock data are more likely to transition from casual to core users.

3. RFM (Recency, Frequency, Monetary) Analysis

Objective:

- Validate segmentation with transactional data.

| RFM Metric | Casual User | Core User | Power User |

|---|---|---|---|

Recency (Last Transaction) | >30 days ago | <15 days ago | <7 days ago |

Frequency (Transactions per Month) | 1-2 | 5-10 | 20+ |

Monetary (Portfolio Size) | < ₹10K | ₹50K-₹1L | ₹5L+ |

Validation Approach:

- Data Source: Transaction history, portfolio size, user retention rate.

- Key Insight: Users with frequent transactions and higher portfolio values tend to engage with more features, confirming the segmentation.

Answer the list of questions in the project guide to determine your hook. This is not a compulsory section; you can opt for it or always revisit it later.

This looks like a whole project in itself. Will revisit it later.

Identifying the industry standard:

Identifying an exact industry standard retention rate for investment platforms like Groww is challenging due to limited publicly available data. However, we can approximate based on available information from similar sectors:

1. Financial Services: The average customer retention rate is approximately 78%.

2. Fintech Apps: The average retention rate stands slightly below the average at 37%, with 73% of new app users churning within the first seven days.

3. Stock Trading Apps: These have the highest average retention among finance apps, though specific percentages aren't provided.

4. Mobile Apps (General): Studies indicate an average Day 1 retention rate of around 25%, decreasing to approximately 6% by Day 30.

Given this data we can assume for a stock trading platform like Groww, we can use the following as reasonable benchmarks:

- Day 1 retention rate of 25-30%.

- Day 30 retention rate of around 10-15%.

Adjusting this baseline retention rate for each ICP using relevant factors:

- Time to Value: How quickly users see benefits from Groww

- Natural Frequency: How often users engage with Groww.

- Competition: How strong competitors are and if Groww offers something unique.

- Brand Value/Word of Mouth: The impact of Groww’s reputation and referrals.

Adjusted baselines according to our ICP’s:

ICP 1: Beginner Investor ("Wealth Builder")

- Time to Value (+5%) → Simple UI, guided investment journeys, and easy onboarding help beginners start investing quickly.

- Natural Frequency (+5%) → Engages at least weekly to check portfolios and explore new investments.

- Competition (-5%) → Competing with Zerodha, Upstox, and mutual fund platforms.

- Brand Value/WoM (+5%) → Groww is well-known among new investors due to social media presence and educational content.

➡ Adjusted Retention Rate: Baseline +10%

ICP 2: Active Trader ("Stock Market Enthusiast")

- Time to Value (+0%) → Requires deeper research and analysis, slightly longer onboarding to set up advanced features.

- Natural Frequency (+10%) → Engages multiple times daily for trading activities.

- Competition (-10%) → Faces strong competition from platforms offering advanced charting and low fees (Zerodha, Angel One).

- Brand Value/WoM (+5%) → Groww is gaining traction but still building credibility for active traders.

➡ Adjusted Retention Rate: Baseline +5%

ICP 3: Long-Term Investor ("Wealth Preserver")

- Time to Value (-5%) → Requires significant trust-building before committing funds to long-term investments.

- Natural Frequency (-10%) → Engages only a few times a year to rebalance portfolios.

- Competition (-5%) → Competing with banks, wealth management firms, and platforms like ICICI Direct.

Brand Value/WoM (+5%) → Groww’s ease of use and lower costs appeal to long-term investors.

➡ Adjusted Retention Rate: Baseline -15%

Assumptions for Retention Decay over 12 Months

- Baseline Retention Rate (X%) after Month 1 = 50%

- Retention typically declines over time, so I’ll apply a realistic decay rate:

- Beginner Investor (ICP 1): Slower decline due to frequent engagement.

- Active Trader (ICP 2): Higher initial retention but may drop fast due to high expectations.

- Long-Term Investor (ICP 3): Starts lower and declines steadily due to infrequent engagement.

The data would look like this for each month:

Insights and Observations

Which ICP Has Better Retention?

- Winner: ICP 1 – Beginner Investor ("Wealth Builder")

- Why?

- More hands-on with technology and apps.

- Actively seeking to grow wealth, so they engage frequently.

- Their lifestyle supports regular check-ins and micro-investing habits.

- High digital affinity → More inclined to use notifications, automated investments, and educational content.

- ICP 2 – Active Trader ("Stock Market Enthusiast")

- Has moderate retention but sees steeper drop-off due to:

- High exposure to competition (Zerodha, Upstox, etc.).

- Frequent switching between platforms for better fees, tools, or execution speed.

- Trading fatigue or losses affecting retention over time.

- ICP 3 – Long-Term Investor ("Wealth Preserver")

- Lowest retention because:

- Investments are not actively managed daily or weekly.

- Fewer logins & engagement, leading to potential drop-offs.

- They may move funds to banks, financial advisors, or direct AMC investments.

Feature(s) Driving Better Retention

1. Auto-Invest + Goal-Based Investing → Stronger Retention for Beginner Investors

- Users who set up SIPs and link them to financial goals stay longer.

- Example: A user investing towards a "Dream Home" is more likely to stay than one investing randomly.

2. Real-Time Market Insights + Advanced Charting → Active Trader Stickiness

- Higher engagement when traders get alerts, insights, and easy technical analysis tools.

- If Groww optimizes this, it can retain more traders from competitors.

3. Portfolio Health Reports + Smart Rebalancing → Retaining Long-Term Investors

- Since they don’t engage daily, periodic automated investment advice can bring them back.

- If Groww offers tax optimization, better rebalancing, and dividend tracking, retention can improve.

You have already created the engagement campaigns, resurrection campaigns are quite similar just keep in mind the churned users that are being targeted here.

(customized your campaigns as per the ICP you're targeting to bring back, add parameters accordingly)

We can use the below resurrection campaigns with clear timelines, frequency and metrics:

Campaign Name | Target Segment & Churn Insight | Pitch/Content | Offer | Timing & Frequency | Success Metrics & Long-Term Engagement |

🛒 Cart Abandonment Recovery | 🔹 Users who abandoned stock purchases/funding accounts (high intent but friction-driven churn) 🔹 Likely causes: Hesitation, complexity, or distractions | “Left something behind? Secure your gains now!” | ₹100 cashback on first investment | Nudge 1: 24 hrs after abandonment Follow-up: 3 days later Final attempt: 7-day exclusive offer | 📊 Immediate: Conversion rate from cart to completion 📈 Long-term: % of these users making a second investment within 30 days |

📢 Dormant User Re-Engagement | 🔹 Users inactive for 30+ days 🔹 Likely causes: Lack of perceived value, no major updates, or shifting financial priorities | “We’ve got new market insights just for you! Your personalized investment opportunities await.” | Free premium feature access (7 days) | Email 1: 30 days inactivity Push 2: 45 days inactivity Final Reminder: 60-day exclusive offer | 📊 Immediate: Login rate post-campaign 📈 Long-term: % of users staying active 3 months post-reactivation |

🔥 High-Value User Rescue | 🔹 Frequent traders with a drop in trade frequency 🔹 Likely causes: Loss of confidence, market volatility, or shifting interests | “Your portfolio is waiting! Maximize your returns with expert insights & trading signals.” | Early access to premium research | Nudge 1: 15 days post-last trade Follow-up: 30 days inactivity Final Offer: Personalized call at 45 days | 📊 Immediate: % of traders returning to platform 📈 Long-term: Increase in trade frequency over next 3 months |

📈 Growth Milestone Emails | 🔹 Long-term investors (Wealth Preservers) who hold assets but rarely trade 🔹 Likely causes: No engagement triggers, passive investing | “Your portfolio grew 10%! Ready for your next move?” | Exclusive investor webinar invite | Email 1: Every quarter Follow-up: 7 days later | 📊 Immediate: % of users engaging with webinar 📈 Long-term: % of users making an additional investment post-webinar |

🚨 Negative Sentiment Recovery | 🔹 Users with low NPS, frequent support tickets, or negative reviews 🔹 Likely causes: Poor customer support experience, technical issues | “We hear you. Here’s how we’re improving based on your feedback.” | Personalized support & goodwill compensation | Immediate response: Within 24 hours Follow-up survey: After 7 days Final check-in: 30 days later | 📊 Immediate: Change in NPS post-response 📈 Long-term: % of users revising feedback or engaging positively |

Long-Term Engagement Strategy Post-Recovery

- 90-Day Retention Monitoring

- Track user behavior before vs. after resurrection

- Identify patterns in feature usage among reactivated users

- ersonalized follow-ups at 30, 60, and 90 days

- Incentivized Milestones for Stickiness

- If a resurrected user completes 3+ transactions in 60 days, reward with exclusive insights.

- If a dormant user remains active beyond 90 days, offer VIP access to investment tools.

- Community & Habit Formation

-Create exclusive user groups (e.g., "Wealth Builders’ Club") for resurrected users

- Gamify engagement (e.g., streak rewards for consecutive months of activity)

🎯 Key Outcomes

✅ Reduce repeat churn by creating long-term engagement loops

✅ Convert one-time resurrected users into loyal investors

✅ Improve overall user lifetime value (LTV) by 20%

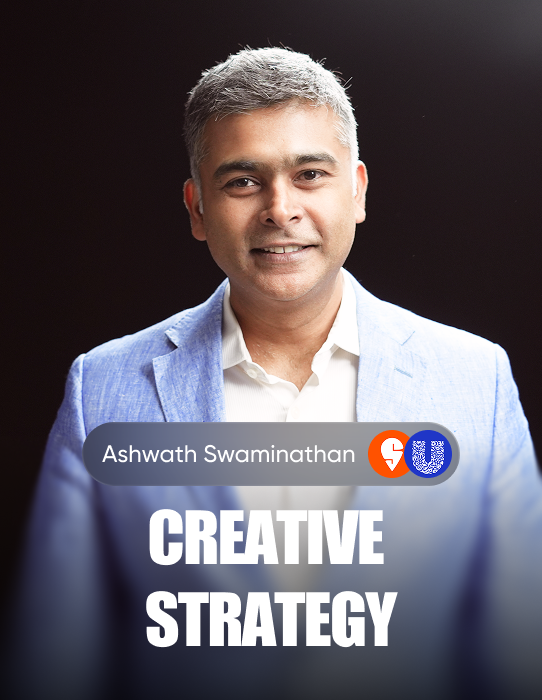

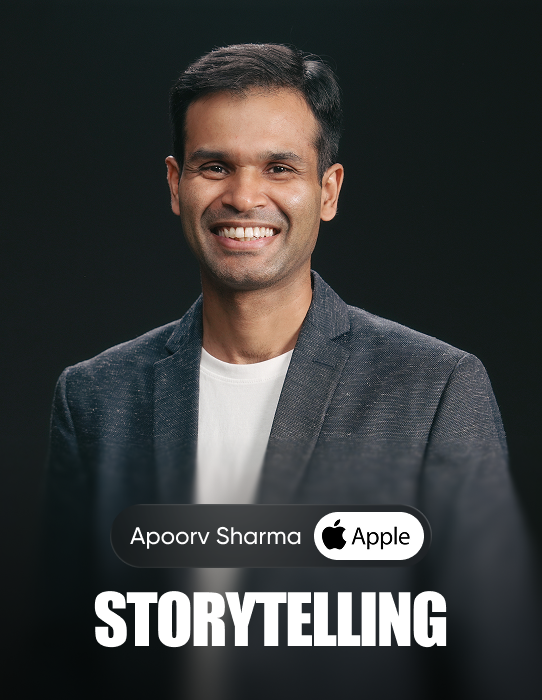

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

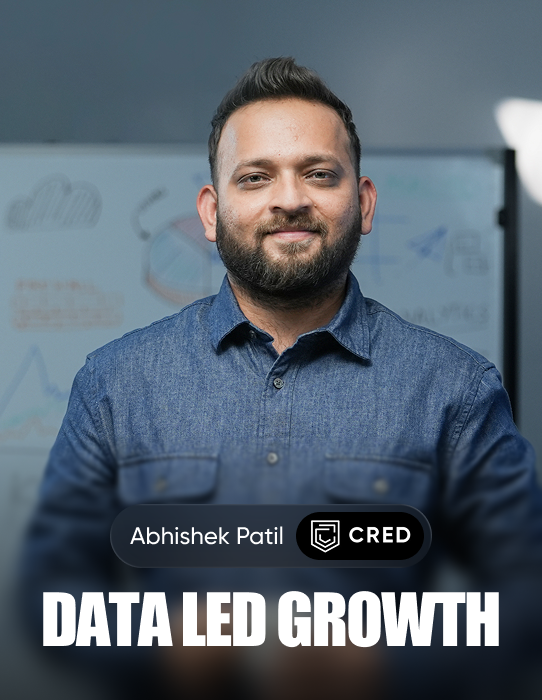

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.